WELCOME HOME!

Here's a look into valuable info, tips, and advice for home buyers and sellers.

Having a high credit score is important all the time, whether you are buying a home anytime soon or not. Your FICO score and credit report are vital to getting any type of loan, and this series will give you the financial strategies you need to get your credit score as high as possible. If […]

Should’ve, would’ve, could’ve. Don’t make that your mantra when it comes to your home’s maintenance! Preventative maintenance is worth your time and money NOW to avoid costly home disasters later. You don’t want to be the one saying, “I should’ve caulked those windows for a few bucks a tube,” when faced with a $2,000 repair […]

Being a homeowner can be exciting and fun at times, with lots of freedom to make it your own space! As a homeowner, though, you’re the one in charge of any repairs, maintenance, finances, and improvements over the long haul. Whether you’re a first time homeowner or you’ve owned many, it’s important to stay informed […]

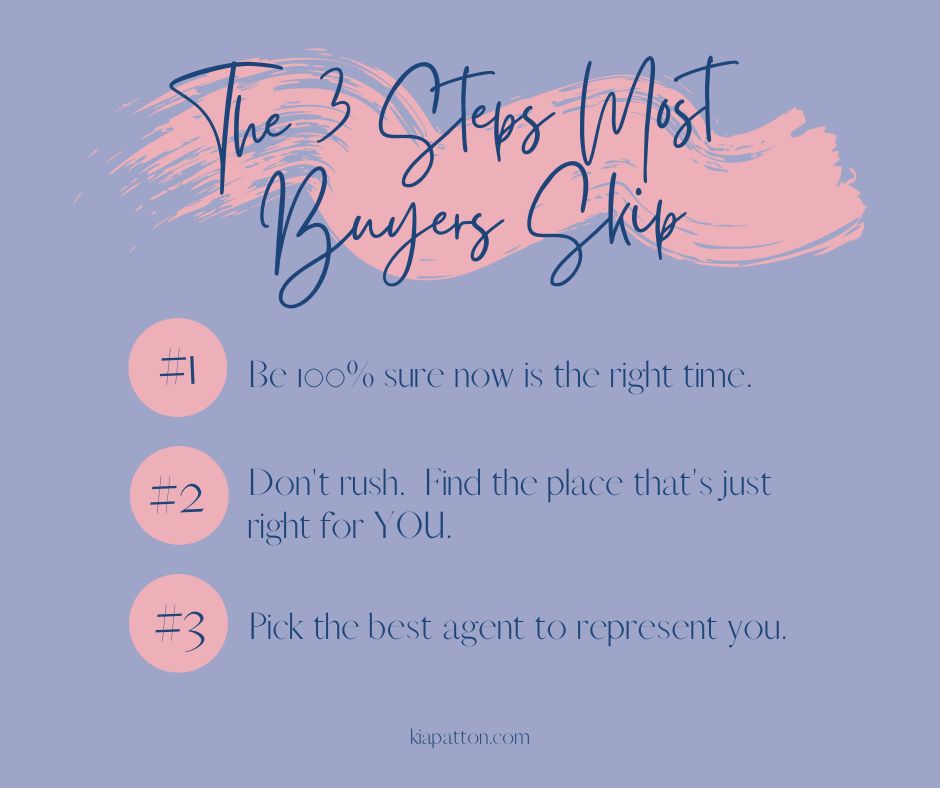

In this series, How to Find the Perfect Home for You and Your Budget, you’ll learn how to find a home that is the right fit for your lifestyle, needs, and most importantly, your budget. It takes you through every single step and shows you how to avoid buyer’s remorse. Your first home is most […]

I believe my job doesn’t end at the settlement table, and I want to be your resource for all things real estate related even after you move into your first home. Below are the questions asked most by past clients who have bought a home with me. I hope the answers to these questions help […]

The Backward (but much more sensible ) Way to Finance Your First Home In this 8-part series, How to Find the Perfect Home for You and Your Budget, you’ll learn how to find a home that fits your lifestyle, needs and, most importantly, your budget. It takes you through every single step and shows you […]

As a homeowner, you should have gained some equity in your home since living there and paying your mortgage down. Have you ever considered using this equity to finance some of your needs if you don’t have the cash flow? A home equity loan or line of credit are two ways to get the necessary […]

Who hasn’t checked out online real estate sites for price estimates of their own home, a neighbor’s home, or even a beach house when on vacation? Most of us are guilty as charged! It’s easy to see why these sites and apps are tempting to use since buyers and sellers can get marketing information directly […]

The 3 Steps Most Buyers Skip When Buying a Home In this 8-part series, How to Find the Perfect Home for You and Your Budget, you’ll learn how to find a home that is the right fit for your lifestyle, needs and, most importantly, your budget. It takes you through every single step and shows […]

In this 8-part series, How to Find the Perfect Home for You and Your Budget, you’ll learn how to find a home that is the right fit for your lifestyle, needs and, most importantly, your budget. It takes you through every single step and shows you how to avoid buyer’s remorse. Your first home is […]